Consumer Awareness Blog:

Have you heard the buzz about the Fed cutting rates but aren’t sure what it means for you?

That’s alright, complex financial terms can be overwhelming at times. In this article we’ll break down recent rate cuts since September 2024 and how they affect everyday people in simple terms.

If you already know the basics, feel free to skip ahead to the section with our practical tips for navigating these changes. For those new to this, we’ve included a quick crash course to help you understand how it all works.

What is the Federal Reserve?

Before getting into the nitty gritty, let’s nail down the basics. The Federal Reserve (“Fed”) is the Central Bank of the United States. This independent government entity controls monetary policy. This means it controls the money supply available and the interest rates it gives to all banks nationwide. In short, the Fed influences how much money flows through the economy and the interest rates at which banks can borrow.

What Are Interest Rate Cuts?

The Fed controls interest rates to help keep the economy stable. Interest rates determine how much it costs banks to borrow money from the government. Based on the interest rate the Fed sets, in turn banks determine their interest rates they offer customers.

For example: If the Fed is loaning money to banks at a 2% interest rate, banks will offer customers a rate higher than 2% in order to make a profit and be able to pay back the government.

Therefore, when the Fed lowers rates it makes borrowing cheaper and incentivizes banks to borrow more and offer customers lower rates.

The Federal Reserve kept interest rates at 5.25% to 5.50% from September 20, 2023, until September 18, 2024. On that day, they lowered rates to 4.75% to 5%. Then, on November 7, 2024, they lowered rates again to 4.5% to 4.75%. The last cut happened on December 18, 2024, to 4.25% to 4.5%. The Fed’s next meeting will be held on January 29, 2025.

Why the Fed Cuts Rates:

The Fed cuts rates in order to encourage spending and borrowing, generally during slower economic times.

There are two key factors the Fed is currently focused on accomplishing:

- Achieving maximum employment

- Lowering the inflation rate, and keeping it at 2% over the long run

To understand why the Fed’s rate cuts are important, let’s look at employment trends in 2024.

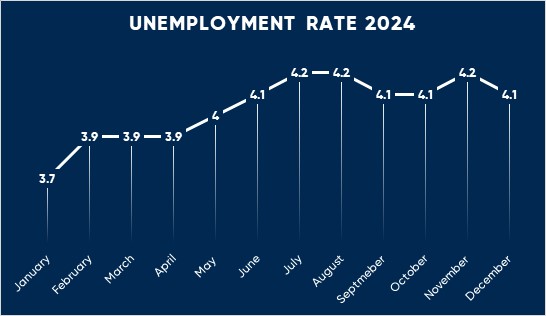

Since September 2024, the Fed has cut rates to foster employment. According to the U.S. Bureau of Labor Statistics, unemployment has increased by 0.5% since the start of the year with an average of 4.03% for 2024. The employment rate tracks the percentage of working-age adults who are employed.

By lowering interest rates, businesses can borrow more money and in turn hire more individuals.

But why is the Fed cutting rates even if prices are high? How does this impact inflation?

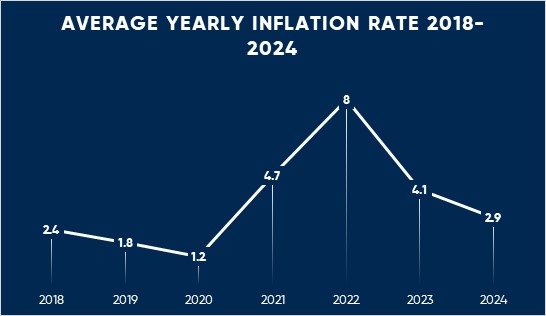

Here is when things get tricky. Generally, inflation is high when the market is booming. However, the past few years post-pandemic, and multiple additional economic factors have shifted the economy. Prices have risen significantly and although inflation on 2024 on average has been 2.9%, with the current inflation rate for November at 2.7%, this doesn’t mean prices have decreased. What this means is the increase of prices is slowing down. This explains why grocery shopping is still much more expensive than just a few years back.

With unemployment increasing, the Fed is trying to boost employment while ensuring inflation doesn’t rise too quickly.

Source: Bureau of Labor Statistics Data

How These Cuts Affect Your Everyday Life

How Does a Rate Cut Affect You?

A Fed rate cut doesn’t just impact banks and financial institutions. It can affect everything from the interest rates on your credit card to the price of a stock as commented below.

Here’s how:

1. Credit Card Interest Rates

- Lower Payments: Many credit cards have variable interest rates, which are tied to the Fed’s rate. When the Fed cuts rates, your credit card’s interest rate might also go down. That means you could pay less interest on outstanding balances.

- Tip: This is a great time to pay down credit card debt since more of your payment goes toward reducing the principal (the amount you owe) rather than paying interest.

2. Savings Accounts and CDs

- Lower Savings Interest: A downside to rate cuts is that savings account and Certificate of Deposit (CD) interest rates often go down too. This means you’ll earn less interest on your savings.

- Tip: Consider looking for high-yield savings accounts that still offer competitive rates, even after a Fed cut.

3. Investing in the Stock Market

- Stocks Might Go Up: Lower interest rates can be good for the stock market. When borrowing is cheaper, companies may invest and expand more, which can lead to higher stock prices.

- Bond Yields Drop: If you invest in bonds, you might see lower returns because new bonds will likely pay lower interest rates.

How Should You Respond to a Rate Cut?

- Pay Down Debt: Take advantage of lower rates to pay off high-interest debt, like credit card balances.

- Review Savings Strategies: Look for high-yield savings options or consider investments that might offer better returns.

The Big Picture

When the Fed cuts rates, it’s aimed at making borrowing cheaper and boosting the economy. For you, it could mean lower payments on credit cards, but also less interest earned on your savings. By understanding these effects, you can make smarter decisions with your money.

Whether you’re a saver or an investor, staying informed about Fed rate changes helps you take control of your finances and plan for the future.

Sources:

Federal Reserve issues FOMC statement

U.S. Bureau of Labor Statistics : U.S. Bureau of Labor Statistics

Disclosure: The information provided in this article is for informational purposes only and should not be considered financial advice or a recommendation to take specific actions. Please note that Pibank USA does not offer lending products or securities/investment products or advice. You should consult with a qualified financial advisor, tax professional, or other expert to evaluate your individual circumstances before making any financial decisions. While every effort is made to ensure the accuracy of the information provided, Pibank USA makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained in this article. Pibank USA is not liable for any losses or damages arising from the use of this information.